Looking for the best invoice software? Whether you’re a freelancer, small business owner, or manage finances for a larger organization, payment processing can be a time-consuming task. But luckily, you can automate many aspects of invoicing with the right software.

When it comes to the best invoice software, what should you look for, though? Some of the features on offer include the option to automate recurring invoices, the ability to take payments straight from your invoice, and a wealth of customization options.

If you’re not sure what to look for, we’ve got you covered – whether you’re a solo entrepreneur or managing multiple complex accounts, there are solutions that can meet your needs. In this post, we explore 10 of the best invoicing software solutions in 2024. Let’s take a look.

- Show Full Guide

Top 10 Tools Offering the Best Invoice Processing Software

When it comes to invoice software, there are a number of great options out there. Our experts at Techopedia have tested several HR and invoicing solutions, and we’re confident that these are the market’s top 10 best invoicing software solutions to use in 2024:

- FreshBooks — A first-rate all-around solution that you can use to customize invoices and automate payments.

- Oracle Netsuite — The ideal solution if you’re looking to bill for flexible subscription-based services and great for larger businesses.

- Sage — Popular invoicing software with a wide range of billing options, including debit card, credit card, Stripe, and PayPal.

- Bonsai — Ideal for businesses with international clients, as you can take invoice payments in a number of different currencies.

- QuickBooks — One of the best options for small businesses, which allows you to process payments directly from invoices and use billable time tracking.

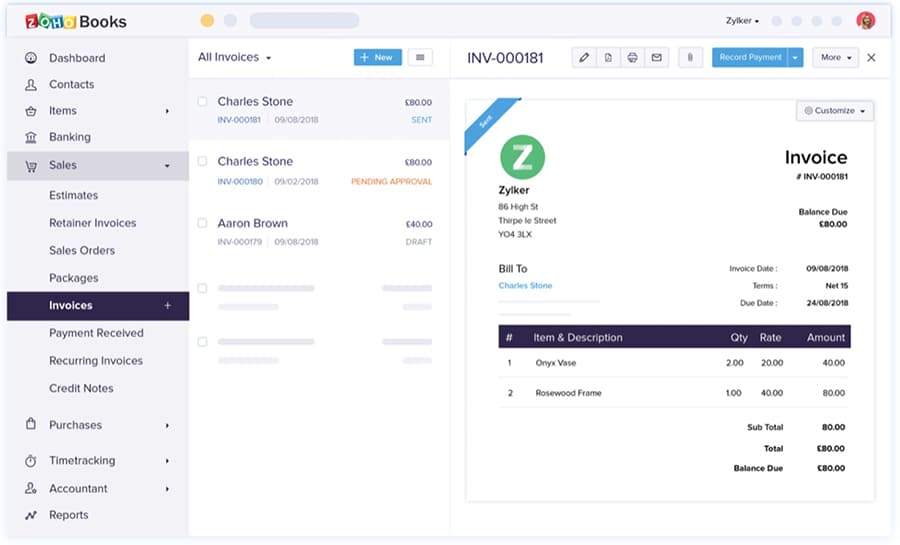

- Zoho Accounting — A brilliant option for small businesses looking to customize invoices and automate invoicing.

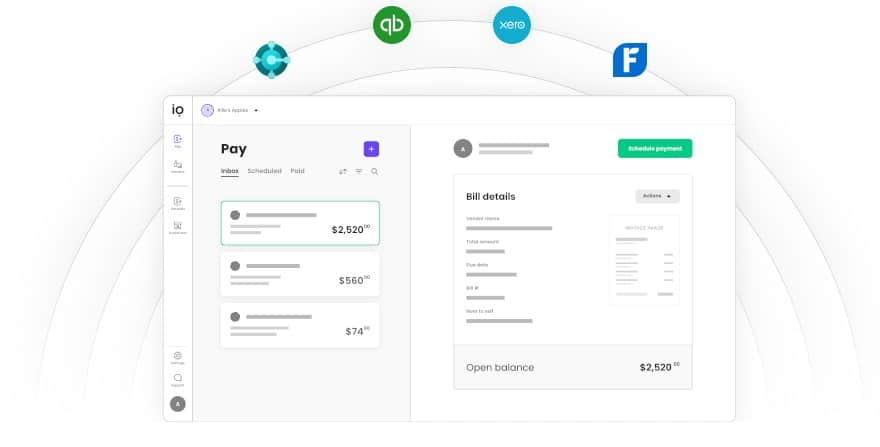

- Melio — Ideal for managing payments and invoices for multiple vendors, contractors, and suppliers.

- Wave — Easily the best free invoicing solution, which lets you track and automate your invoices at no cost

- Xendoo Online — A great choice if you’re looking for comprehensive accounting support from qualified expert accountants

- Invoice2go — Created with contractors in mind, this tool is great for creating invoices from wherever you are, from the app.

Why Do Businesses Need Invoice Software?

With manual software, it’s easy to make mistakes or lose track of payments. Manual invoicing can hold your business growth back, add to your stress levels, and take up your time. That’s where invoicing software can help. Let’s take a look at some of the benefits.

Save Time

Paper-based invoicing can quickly eat into your workday, requiring you to create detailed invoices, chase late payments, and track your expenses. With software that offers pre-built invoice templates, automated payment reminders, and the ability to create recurring invoices, you can save time on invoicing every month.

Centralize Your Data

When you can view your invoicing data from a single platform, you can quickly capture a bird’s eye view of your finances – getting a quick snapshot of your expenses, revenue, gross profits, paid invoices, pending invoices, and overdue invoices.

It’s much easier to review and understand your finances when all your data is centralized on one platform.

Customizable Invoices

Rather than sending over a Word Doc mock-up, you can use invoice software to craft fully customized, professional-looking invoices. Not only does invoicing software create sleek invoices in minutes, but you can also use these solutions to develop your brand identity by adding your brand logo and brand colors.

Reduce Mistakes

The best invoice apps and platforms can also reduce your chance of making mistakes. By automating recurring invoices, centralizing and organizing your invoicing data, and taking payments right from your invoices, you can track your finances with ease and identify and fix mistakes.

Get Paid Faster

Is there anything more frustrating than spending weeks or months chasing a late payment? Sage reports that 11% of all invoices sent out by small and medium-sized businesses are paid late, accounting for a total of $1.01 trillion per year.

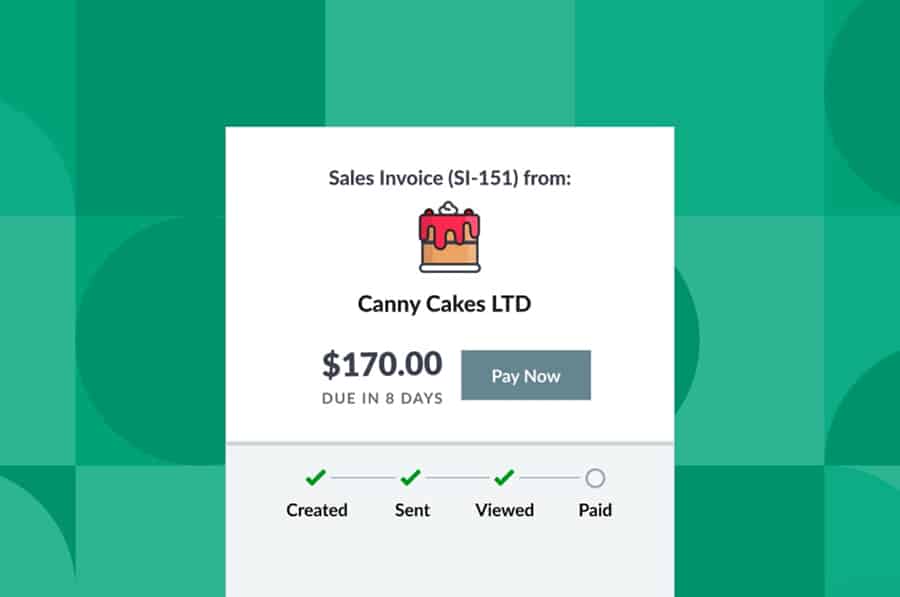

With the best automated invoice processing software, you can send automated reminders. This can help ensure you get paid faster than you would if you had to chase payments manually. As a bonus, several invoicing software solutions include “pay now” options for customers who pay with credit or debit cards.

Manage Scale

If you’re creating invoices in Word, you only have so much space before storing, organizing, and retrieving invoices becomes a headache. That’s not to mention that you could accidentally overwrite one of your invoices and lose track of a payment you need to chase or add to your tax records.

With invoicing software, all your invoices are centralized and stored in the cloud rather than on a device. This means you can easily review, track, and account for all your invoices while out and about on any device.

Key Features You’ll Find with The Best Invoice Software

Now that we’ve covered the benefits of billing software let’s review the features the best online invoice software solutions have in common. From the ability to fully customize your invoices to automating recurring invoices, here’s what you need to look out for:

Online Payment Functionality

To tackle this, you want to ensure that making a payment is as easy and hassle-free as possible for clients. That’s why you don’t just want software that allows you to drop your bank details on the invoice. Ideally, your customers will be able to make payments from the invoice itself.

Look for options that allow your customers and clients to make credit, ACH, and debit card payments straight from their invoices – something that providers like FreshBooks and Bonsai offer.

Automated Payment Reminders

With the best invoice management software, you can automate the majority of the process.

You can use the best invoice processing software to set invoice payment reminders both before and after payment is due, such as three days before payment is due, on the day, or a week after your payment should have been in your bank account.

Customization Options

The best invoice software, especially if you’re looking for the best small business invoice software, is one that allows for a ton of customization options. As a freelancer or small business owner, your brand presentation goes a long way in impressing and retaining your clients.

The best small business invoicing software or self-employed accounting software on the market will offer several invoice customization options – from adding your logo to changing your font type.

Deliver Repeat Invoices

Do you work on a retainer or have a set number of deliverables for a client each month? That’s where recurring invoices come in. Look for invoice software that offers the option to automate the creation of recurring invoices for clients with the same monthly deliverables. This will save you a ton of time each month.

An Easy-To-Use Dashboard

The best invoicing solutions offer an accessible dashboard that provides a visual overview of your income and expenses to easily monitor your cash flow and see how your business is performing for the year. You also get a snapshot view of which invoices are still pending payment and which have been paid.

Reviews of the Best Tools for Invoicing

Now let’s dive into 10 of the best invoicing software solutions, from the best free invoice software to the best invoicing software for a small business. We’ve narrowed down the list to providers that offer the best capabilities for a range of users and have explored what stands out for each of the top solutions.

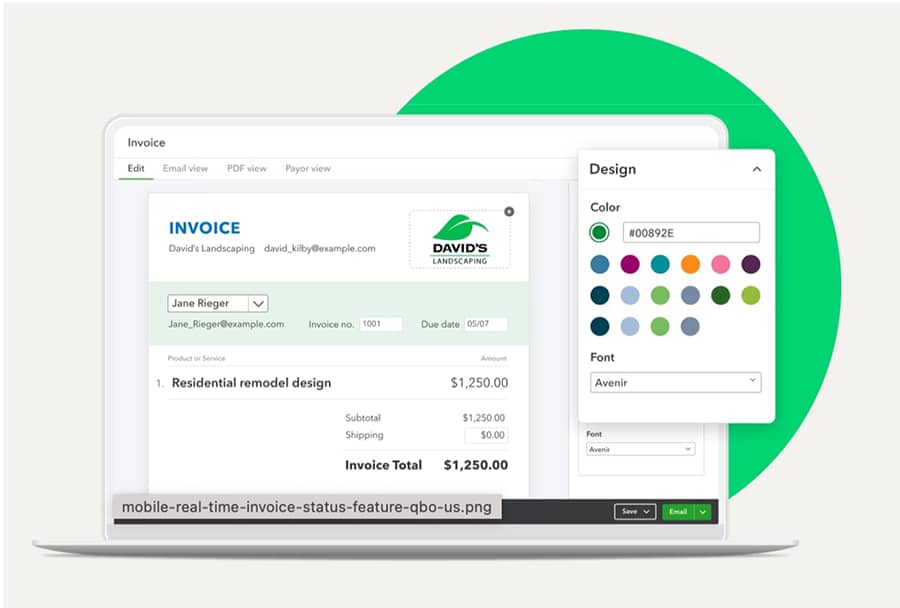

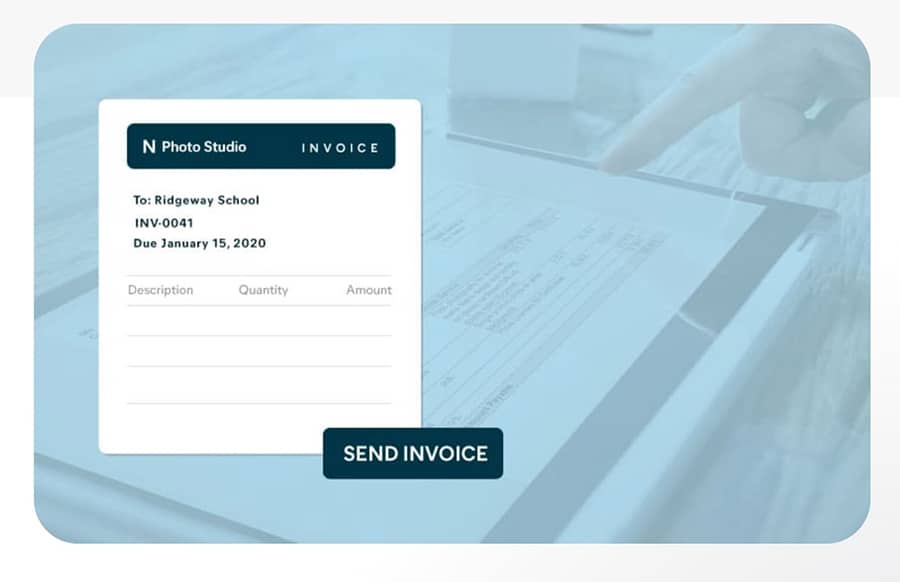

1. FreshBooks — Leading All-Around Invoicing Software for 2024

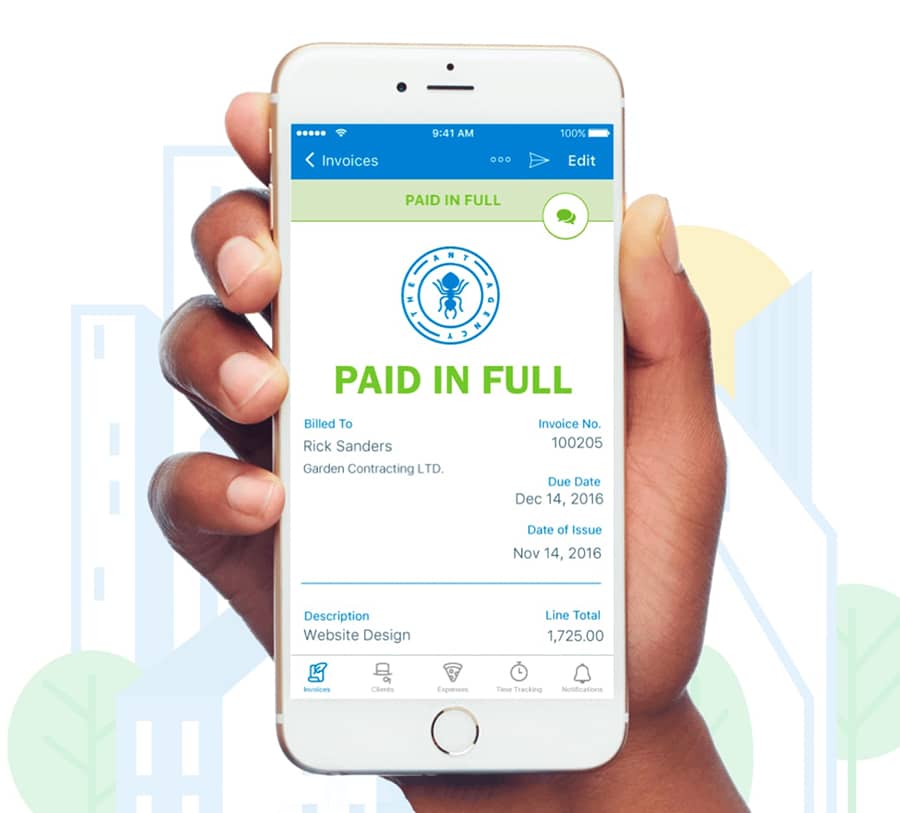

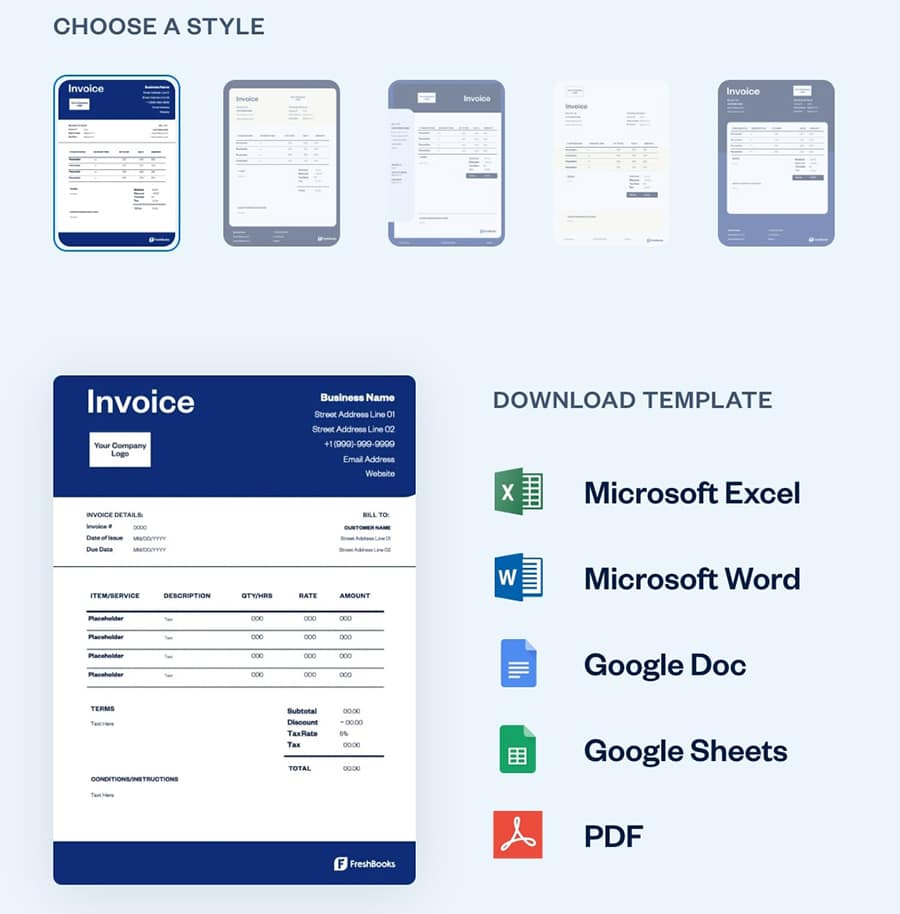

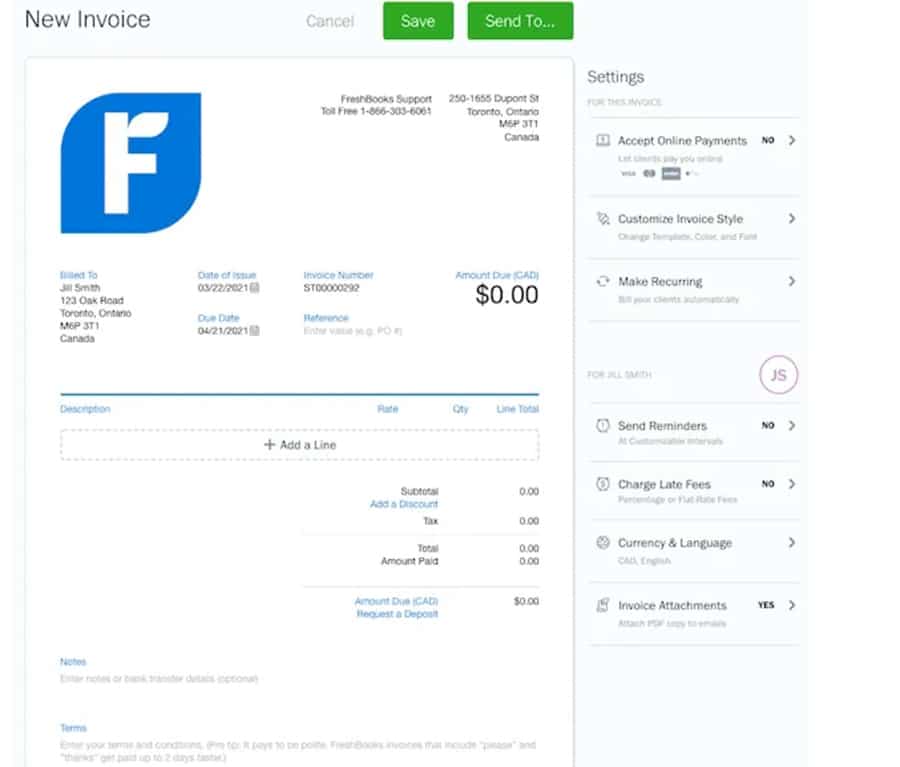

First up is FreshBooks. You can use FreshBooks’ invoice generator to create professional-looking invoices in seconds. We found that FreshBooks delivers a great aesthetic, with impressive invoices and “thank you” emails that you can fully customize with your brand colors, font, and logo, helping to enhance your brand experience.

With FreshBooks, you can accept several popular payment methods right from your invoice, too – including debit cards, credit cards, and Apple Pay.

As the majority of businesses experience late payments, FreshBooks prides itself on giving you the means to get paid nearly two weeks faster than normal – a claim that’s backed by a number of reviews on popular review sites like Trustpilot.

| Best For | Starting Price | Free Version | Payroll Included | Top 3 Features |

| All-in-one invoicing solution | $8.50/month | 30-day trial | Yes | – Great customization options – Take deposits with a percent or flat fee – Add-ons include Gusto Payroll |

You can also use FreshBooks’ automation tools to send payment reminders, set up recurring invoices, and charge late fees using your customers’ on-file credit cards.

If you’re a small business owner or freelancer, then you likely already know the security upfront payments and deposits can provide when it comes to your cash flow. With FreshBooks, you can request a deposit to be paid before you begin a project – just choose from a percentage or a flat amount.

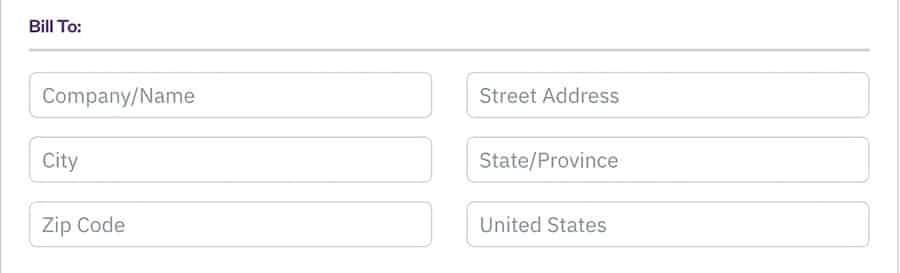

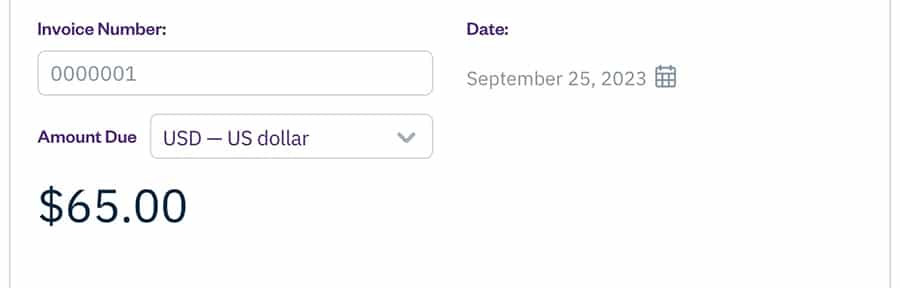

We found Freshbooks’ invoice generator to be very easy to use. If you bill by the hour, you can easily add your tracked time to invoices, and you can add billable expenses to your client. Plus, you can keep customers in the loop by sending summary points at any stage.

Whether you’re looking for the best accounting software in the U.K., U.S., or elsewhere, FreshBooks is a winner, particularly when it comes to customizability.

You can easily add due dates, specific payment terms, tax calculations, discounts, and currency specifications to each invoice. With these features, you can create multiple invoices in minutes.

With FreshBooks, you can also choose add-ons like advanced payments, which you can use to charge clients’ cards ($20/month), and Gusto Payroll.

However, one downside to FreshBooks is that it places a limit on the number of clients you can invoice via the platform on their lower-tier plans – for example, with their Lite plan, you can only send invoices to five clients.

If you’d like more information on FreshBooks’ capabilities, check out our in-depth FreshBooks review.

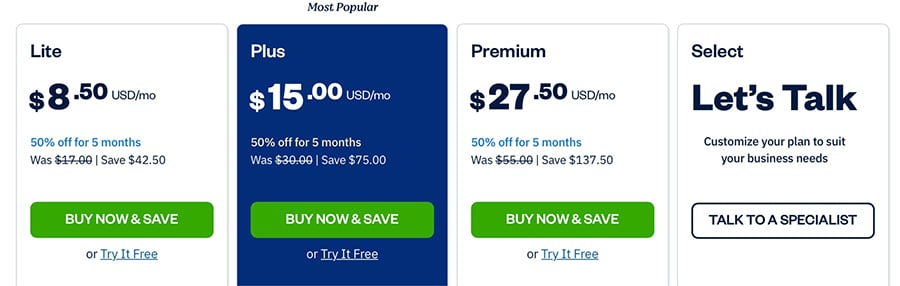

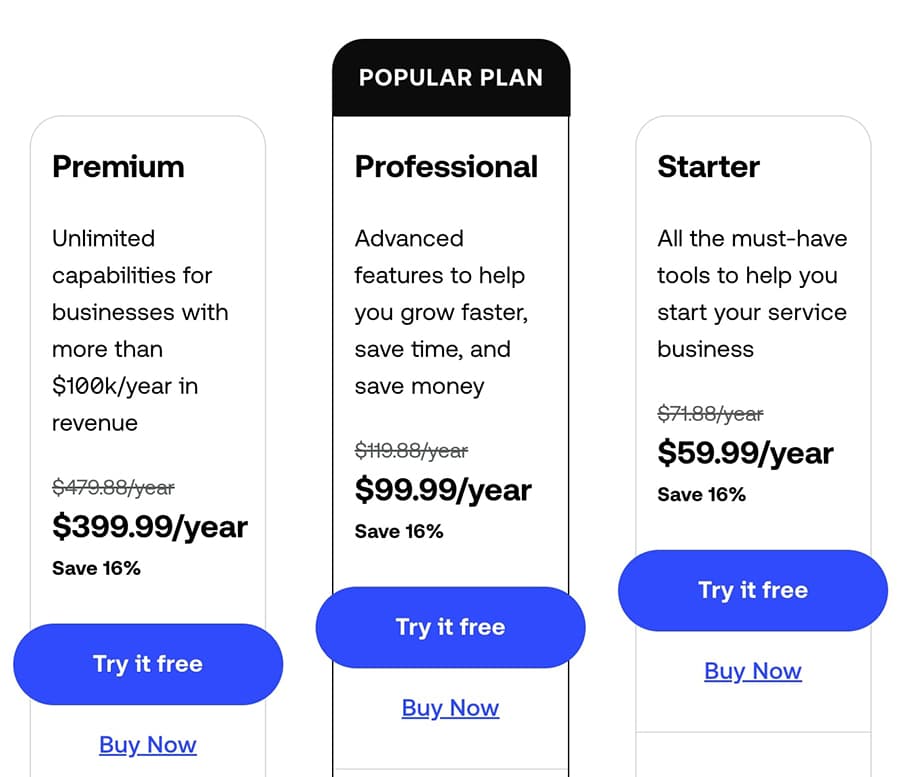

Pricing

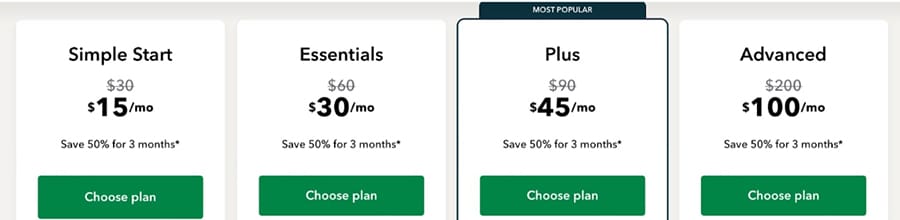

FreshBooks has four pricing plans. Lite permits one user and is ideal for freelancers and small business owners. With it, you’ll be able to send unlimited invoices to up to five clients, send unlimited estimates, get paid by credit card or bank transfer, and use iOS or Android apps to access your invoices on the go.

If you want to send invoices to more than five clients and access features like custom email signatures, payment tracking, and a dedicated account manager, you’ll want to look to upgrade to the Plus or Select plans.

Pros

- Multiple customization options

- Variety of payment options

- Take up-front deposits

- Invite your accountant or connect with a dedicated account manager

Cons

- Not ideal for large businesses

2. Oracle NetSuite — Great Solution for Larger Firms

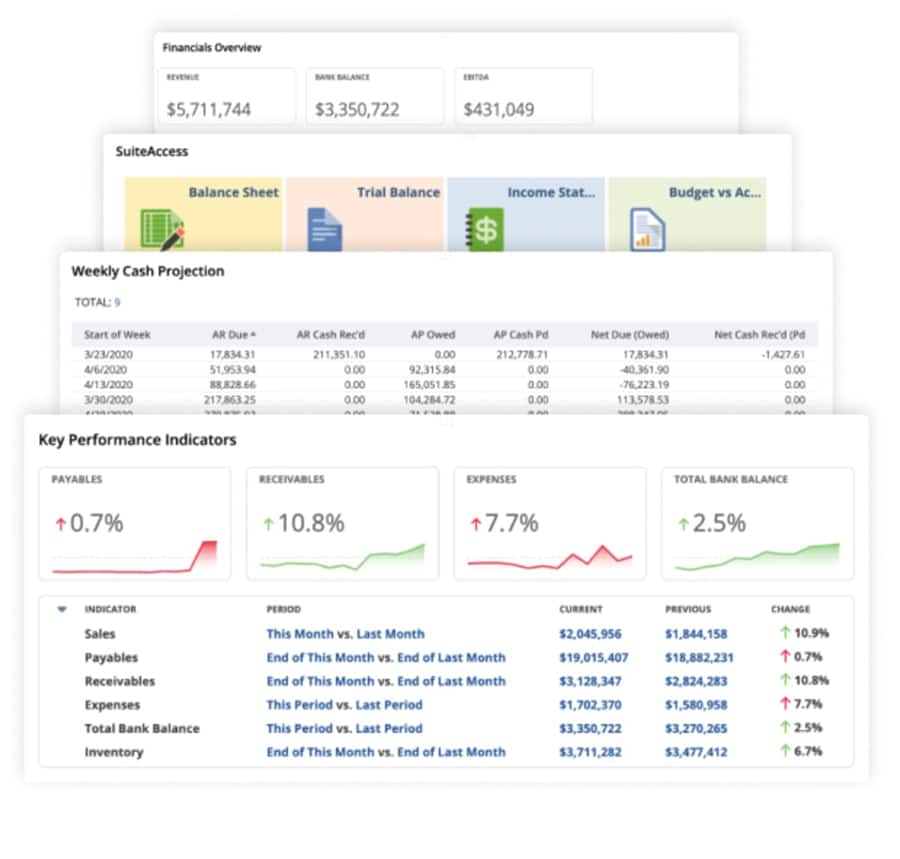

Oracle NetSuite is a business management solution that offers several capabilities in one, from the ability to take payments in several currencies to automated changes to subscriptions.

Their invoicing solution, SuiteBilling, offers several unique features. Designed with the subscription economy in mind, SuiteBilling supports you in creating invoices that reflect usage and pricing over a specific period of time.

SuiteBilling supports a number of pricing models to help simplify your billing, including a simple flat rate, a volume model based on consumption, and a tiered model, where pricing is based on passing payment thresholds. You can also use SuiteBilling to account for customer-specific discounts.

While you can use NetSuite to craft invoices for one-off transactions or product sales, it really shines for subscription-based services. You can schedule and automate changes to subscriptions, pricing, and renewals. If this isn’t your business model, however, or you have a relatively small operation, then you may find a better fit with other solutions that offer accounting software and invoicing capabilities, including Bonsai. We were particularly impressed with NetSuite’s automation features. Invoices automatically update to reflect changes, saving you time manually updating them. Getting paid on time is all about offering payment methods that work for your clients. NetSuite integrates with PayPal and allows you to take payments using bank transfers. You can also take payments in over 190 currencies, making it a solid global solution. Beyond all this, you can track your accounts and invoices with NetSuite’s real-time analytics, which provide a granular look at your business’s financial performance. As we noted above, NetSuite offers a host of tools to help support the growth of your business. If you’re looking for the best CRM software solutions with inventory management alongside invoicing, NetSuite is a top choice. While NetSuite offers a number of impressive features for subscription-based businesses, we did find there was more of a learning curve when it came to getting started with the software when compared to other invoicing software. As NetSuite is uniquely tailored to the needs of your business, the firm doesn’t provide set pricing plans. However, you can expect a base charge of $99/month and $120 to add a user. As it’s a custom package, the service can hit $1,000+ per month, so it’s really geared toward businesses that need sophisticated solutions. Sage offers cloud-based financial services management software that gives you real-time insights into your business finances in easy-to-review charts and graphs. You can use Sage to track your revenue, expenses, and net income. You can also easily track when your invoices have been viewed and paid, making it a brilliant solution if you have several client invoices to track each month. With Sage, you can send personalized invoices to clients in seconds, with eight templates to get you started. You can customize your invoices with your clients’ details and set up automated invoices to send out each month, saving you a ton of time on manual invoice creation. However, Sage does offer far fewer options than Bonsai, for example, which offers 100+ templates. If you’re a small business owner who’s always on the go, communicating with prospects and customers across channels, you can use Sage to help get your invoices paid quicker from wherever you are – online, on the phone, or in person. Sage shines when it comes to billing options, too. You can use it to process payments, set up recurring bills, and process refunds, and as you’d expect, you can also speed up payments with a Pay Now button on each invoice. You can even integrate Sage with payment processors like Stripe or payment gateways like PayPal and take credit or debit card payments. While we were impressed with the extensive features Sage offers, it has something of a learning curve compared to other, more user-friendly solutions on our list, like Wave and FreshBooks, which you can set up and use in minutes, meaning Sage is a better choice for more tech-savvy teams. Sage is a super affordable option, which is perfect for smaller businesses and global brands alike: Sage Accounting Start includes one user, making it a great choice if you’re a freelancer. You can use it to send, manage, and track multiple invoices. The next option is Sage Accounting, which offers great value for money as it supports unlimited users and additional features like cash flow forecasting and the ability to send quotes and estimates. Bonsai is easily the best if you’re looking to process global payments. You can handle credit cards, PayPal, and ACH payments, giving your global customers a wide range of payment methods. Although not as many as Oracle Netsuite, Bonsai gives you the ability to take payments in over 100 different currencies – more than enough for the vast majority of businesses with a global reach. Whether it’s small business invoicing or you’re a larger company with 50+ invoices to process every month, Bonsai is a great option if you deal with international clients. In addition, Bonsai also goes all-in on automation. You can automate every stage of the invoicing process, from invoice creation and invoice scheduling to sending out reminders and the collection of late fees. Another cool feature of Bonsai is that, like solutions like Oracle NetSuite, you can use it to set up recurring and subscription billing for clients you have on retainer – making it a great choice if you’re looking to manage a number of long-term projects. You can bill clients weekly, monthly, or quarterly. If you’re confident in creating invoices and want to add brand colors and logo, Bonsai offers lots of customization tools. Like several others on our list, including FreshBooks, Bonsai also offers several free invoice templates, including options for freelancers. You can create custom invoices with unique conditions, special payment terms, and customized line items. Another added bonus? You can add team collaborators to review invoices for free and tax assistants for just $10/month. However, if you want an invoicing solution that provides expert accounting support and assists with annual tax returns, then check out Xendoo. You can also review your invoices on the go using the Bonsai app, but you can’t make changes. This was the only downside we could find with Bonsai. For this, we’d recommend Invoice2Go. Bonsai offers three payment pricing plans, starting at $25/month. The Starter plan is tailored to freelancers and contractors, providing access to all invoice templates and unlimited clients. The Professional plan is ideal if you’re a growing independent business looking for greater automation and integrations with platforms like Calendly and Zapier for better project and invoice management. If you’re looking for the best invoice software for a small business, the Business plan is built for small businesses and agencies with subcontractors and who want to provide platform access to a wider team. All plans can be billed monthly or annually. QuickBooks is one of the top choices if you’re looking for the best invoice software for freelancers or small business owners. It has several features tailor-built to help small businesses grow, from taking in-invoice payments to billable hour tracking. Like the other options we’ve covered here, you can fully customize all your invoices – from colors to dropping in your logo. One of the best features of QuickBooks for small businesses is the real-time tracking that allows you to monitor when customers view and pay your invoices, making managing your cash flow that much easier. New to invoicing? QuickBooks offers expert support on each of their plans with their Guided Setup. While we were impressed by the usability of FreshBooks and Wave and think they’re great choices for hassle-free accounting and invoicing, the support offered with the Guided Setup is an awesome addition if you’d like more peace of mind when it comes to your accounting and using your invoicing software. Your expert bookkeeper can help you set up your chart of accounts, connect your bank accounts, and talk you through some of the best financial practices for your small business. This makes it a great choice if you’re a small business owner and you feel less confident managing your business finances but isn’t much of an added bonus if you’ve been running your business for years and have plenty of experience. With QuickBooks, you can also automatically add all your billable hours to your invoices with the Google Calendar integration. In addition, you can get paid straight from your invoice. QuickBooks will automatically record these payments for you, saving you time on bookkeeping and ensuring you’re kept updated on what’s been paid when it comes to all your estimates and invoices. While QuickBooks offers many features and benefits for small business owners, including the billable hours and additional bookkeeping support we cover above, it can be a more expensive choice if you’re a larger business looking to accommodate more users and get more advanced features. QuickBooks is super affordable, with prices starting at just $15/month. You can choose from four tailored plans, but what makes this solution unique is that you get free expert support included in the price for each plan. Zoho Accounting is an all-in-one invoicing solution that matches FreshBooks and Bonsai with features such as customizable invoices, the ability to set up recurring invoices, and automated reminders for invoice payments. It also has some unique benefits, though. Like Sage, Zoho Books gives you multiple choices when it comes to getting paid by your clients. To help you get paid faster, your customers can go for whichever option works best for them – including cash, checks, and digital payments. In addition, you can also collect deposits and advance payments. If you have clients around the world, then Zoho Accounting could be a great option for you. With its multi-currency pricing options, you can charge customers in their preferred currency. Not only that, but you don’t have to make a record of these payments as they come in, as Zoho automatically records them. This is perfect for anyone after the best invoice software for contractors or freelancers who need to maximize their time. Beyond all this, one of the best features of Zoho Accounting is that you can use it to verify transactions before you send them, which can help you avoid any frustrating mistakes. One thing to note is that with the basic plan, you can’t add any additional users, but you can add an accountant. As such, you may find Zoho Books less desirable if you have a large team and want to add several users to your account. With their highest-paid plan at $240 per month, you can add a max of 15 users, and you’ll need to pay to add extra users. Zoho Accounting is totally free to use if you turn over less than $50,000 a year. You can upgrade to a number of plans with more advanced offerings like custom reports, recurring billing, and advanced multi-currency handling. Melio is an online business payments platform that you can use to create professional-looking invoices and pay vendors, contractors, and suppliers, all from a single platform. If you have a larger business with more complex operations and a number of vendors and clients to juggle, then Melio could be the solution for you. With Melio, you can add an invoice in seconds or easily sync your accounting software with the platform to start sending invoices to clients. However, unlike the other solutions listed here, Melio isn’t built with invoice generation in mind and offers less functionality in this area. Despite this, you can easily sync it with several other invoice software providers on our list – including QuickBooks and Freshbooks. What’s nice is that Melio instantly matches all incoming payments with invoices to help you avoid any mistakes when it comes to tracking and recording them. Melio also helps you save time on admin by letting you track and manage payment requests on any device. It also offers a ton of transparency, making it an ideal choice if you stress over tracking your payments. Melio’s invoicing software tracks emails and reminders, including when payments are scheduled, when payments are being processed, and when they’re made in full. Melio also understands how irritating extra surprise fees can be for businesses and clients, so they offer several ways to pay each invoice, including free ACH bank transfers and credit card payments with low fees (giving you or your clients the option to pay the fees). You can also use the platform to share personalized payment page links that feature your business card, email signature, or site – helping to boost your client’s brand experience as they pay for their products or services. When it comes to pricing, Melio stands out as it’s totally free to use. However, you do have to keep their fees in mind, which are as follows: Wave offers free invoice software and prides itself on allowing you to create beautiful invoices, accept online payments, and easily review and track your accounts from a single dashboard. One thing that stands out with Wave is that it offers a user-friendly dashboard for reviewing your cash flow, profit and loss, and invoices. From here, you can quickly pinpoint any overdue invoices that need to be chased up. This makes it a great option if you’re easily stressed out with tracking payments, bills, and overdue invoices. While other solutions like FreshBooks also offer charts on accounting and invoices right from the dashboard, the way Wave presents financial information really stood out to us. Wave offers a range of brightly-hued, super-clear charts and graphs that compare different financial markers of your business based on the financial year. With Wave, you can create sleek-looking invoices in minutes. To add to the professional look and motivate clients to pay faster, you can add a Pay Now button as well. Clients also have several payment options, including credit cards, an ACH or EFT bank payment, or Apple Pay. You can also send all your invoices with Wave’s free invoice app for both Android and iOS. Plus, Wave also shines when it comes to automation. Your invoicing and payment information automatically syncs with Wave’s free invoice software, helping you save time on bookkeeping. You can also set up recurring billing for repeat buyers, making it one of the best options if you work with several retainers. One downside? You can’t add billable hours to Wave like you can with solutions like Invoice2go. Wave is totally free to use – making it an ideal option if you’re looking for the best accounting software for small business needs. Xendoo’s online invoicing software is easy to use and offers several customizable templates where you can add your payment terms and logo, as well as send automatic reminders. With this, as with all the best invoicing software solutions, you won’t have to waste any more time chasing late payments. Xendoo also offers a ton of transparency, allowing you to review whether customers have viewed or paid your invoices right from the dashboard. Xendoo is all about supporting small businesses, so if you’re looking for help getting set up with your accounts or have any tax or accounting questions, you can schedule a 20-minute call with one of their trained accountants. Whether you’re looking for some of the best tax accounting software or for expert accounting support, Xendoo could be perfect for you. Xendoo also provides additional support from a dedicated bookkeeping team that can help you manage your weekly accounts. Moreover, you can add tax guidance and get an Annual Federal and State Tax Return on top of your standard plan for $1,200/year, which includes year-round tax support. The team also offers additional financial services, including catch-up bookkeeping (starting at $295/month) if you’re falling behind and a fractional CFO (starting at $1,500/month) to help scale your business. This additional support can go a long way if you stress about your business finances and accounting. At first glance, Xendoo may look expensive, but its plans stand out as they provide full bookkeeping support. If you think you can benefit from additional bookkeeping support, consider giving Xendoo a look. Beyond the Essential plan, which provides a dedicated bookkeeping team and the ability to link up to four bank or credit card accounts, the Growth plan lets you connect six and get a semi-annual tax consultation. The Scale plan, on the other hand, lets you link up to 12 bank or credit card accounts and get a custom chart of accounts as well as bi-weekly calls. Invoice2go is all about making it easy to craft and send beautiful, customized invoices from wherever you are. With a user-friendly interface designed to be accessed from any device, it’s a great option if you’re a contractor who works with clients outside of the home or office and wants to create invoices on the go. Another cool feature of Invoice2go is that you can use it to send invoices to your clients on their preferred channels, whether that be via text, email, WhatsApp, or even Facebook. This makes it an ideal choice if you work with a range of clients, as it makes it easier to track client communications and get paid on time. Do you also hate keeping track of your invoices and payments? You can use Invoice2go to set up notifications for when your invoices get paid or when they’ve been viewed by your clients. Plus, you can also automate payment reminders. Beyond all this, you can easily track your time on the job and add billable hours to your invoices, just like you can with QuickBooks – that’s another reason why it tops the list as some of the best invoice software for contractors. Better still, you can also get online client approvals and deposits and automatically convert them to invoices – helping you save a ton of time on invoicing. Invoice2go offers three plans to choose from: The Starter plan offers 30 invoices per year, but additional perks include free bank transfers and bank account integration. The Professional plan is best if you’re looking to grow your business as it offers 100 invoices per year and lower card payment fees than the Starter plan at 3.5% vs. 3%. The Premium plan is top tier and offers unlimited invoices, provides phone support, and offers the lowest card payment fees at 2.9%. Now that we’ve explored our solutions in-depth let’s see how they stack up against each other so you can find the right one for you: If you’re looking for the best free software, you can’t go wrong with Wave. As one of the best free invoicing software solutions out there, you can do a lot with Wave without having to pay a cent. You can use it to create and customize beautiful invoices to help build your brand. In addition, you can automate much of the invoicing and payment process by accepting online payments straight from your invoices, automating recurring invoices and sending payment reminders both before and after your payment is due. We love how usable Wave is. The visual dashboard lays out your cash flow, profit, and expenses in color-coded charts and gives you a quick overview of overdue invoices. As a free tool, Wave is an awesome option if you’re a freelancer or a startup. That said, whether you’re looking for the best invoice app for small business or for enterprise that offers additional features and accounting support, we recommend choosing invoice software like FreshBooks, Oracle NetSuite, or QuickBooks. As a growing business, these can help provide you with what you need to handle more complex accounting and invoicing needs. With the right invoicing software, you can create impressive-looking invoices and automate much of the invoicing process. But to find the right software for your business, there are several factors you need to consider. If you’re like many business owners, one of the main reasons you’re looking into invoicing software is likely to be to save time. That’s where automation capabilities come into play. Look for software that allows you to automate the bulk of the invoicing process, such as invoice creation, recurring invoices, chasing payments, and recording payments. From Oracle to Bonsai, the majority of the billing software solutions on our top 10 list offer automation capabilities. If you’re a freelancer or small business owner, you’re likely looking to reduce costs – 57% of businesses report they cut costs in 2022. As such, price is likely top of mind, making it all the more important to weigh up the capabilities you need alongside your budget considerations. While we’ve listed several sophisticated solutions that come with additional accounting and bookkeeping support, you need to consider how much you can afford and want to spend. There are several choices for affordable and even free invoice software solutions, such as FreshBooks and QuickBooks. That said, current costs are important, but you’ll also want to factor in the cost to scale when the need arises. Solutions like Xendoo and Bonsai are great choices if you want to balance cost with affordable scalability. While you can use invoicing software to create invoices far faster than you can manually – bland, formulaic invoices won’t help create the best brand experience for your customers. When considering invoicing software, you want one that lets you customize your invoice with your own brand designs. FreshBooks, Zoho Accounting, and Xendoo are some of the best options if you want to craft personalized invoices for your business. The more usable your software is, the less stressful it’ll be to run through your invoices every month. You want a clean, easy-to-navigate interface that clearly lays out your invoicing and other financial data, such as a solution like Wave. Case in point – you can review graphs of your financial data and a list of unpaid invoices from your dashboard. Look for features that simplify and optimize the invoicing process. Some features to consider: prepopulated line items and customer details, automation features, and the ability to create and to customize your invoices in just a few clicks. Some of the options on our list include additional features that could go a long way in helping you grow your business and are particularly helpful if you’re seeing year-on-year growth and need to streamline your business processes and get additional accounting support. Solutions like Xendoo offer such support from a dedicated bookkeeping team who can help you take care of bookkeeping week-by-week and do your end-of-year tax return for you. It’s always a good idea to try before you buy to see if a solution can meet your business needs. We’ve included several invoicing software options on our top 10 list that offer a free trial – including Sage, Bonsai, and FreshBooks. Not sure how to create an invoice for your small business? We’ve got you covered. FreshBooks is one of the best accounting tools out there – here’s how you can use it to create an invoice: Once you’re set up with FreshBooks, and have a template ready to go, add your name, contact details, and business address at the top of the invoice. Add your customer’s details – including their name and address and add a line item for each service or product you need to invoice for. You should include a short description of each service or product, the quantity, the rate, and any additional taxes due. Once you’ve added your line items, you should include the total amount your clients owe under your line items, factoring in discounts and taxes in your calculations. This includes your banking information and payment terms, for example, payment being due in 14 days. If you want to take payment via credit card, then include a payment link in your invoice. Also, consider final touches – you should include your company logo and brand colors to help provide a professional edge for your invoices. We’ve researched and tried each of the top-ranking invoicing software solutions currently on the market. Whether you’re looking for templates to help you create professional-looking invoices or an all-in-one solution that automates payment reminders and offers bookkeeping support, this list includes the very best invoice software solutions to simplify and speed up your invoicing each month. Of them, we rate FreshBooks as our top pick. You can use FreshBooks to create impressive, professional invoices, complete with your own personal branding, in just a few clicks. With the ability to take deposits for projects, automate invoice creation, and offer clients the chance to pay via debit cards, credit cards, and Apple Pay, FreshBooks delivers in a wide range of areas when it comes to invoice creation and processing.

Best For

Starting Price

Free Version

Payroll Included

Top 3 Features

Larger businesses

$99/month

N/A

Yes

– Tailor invoices for subscription services

– Schedule and automate subscription changes

– Automate renewalsPricing

Pros

Cons

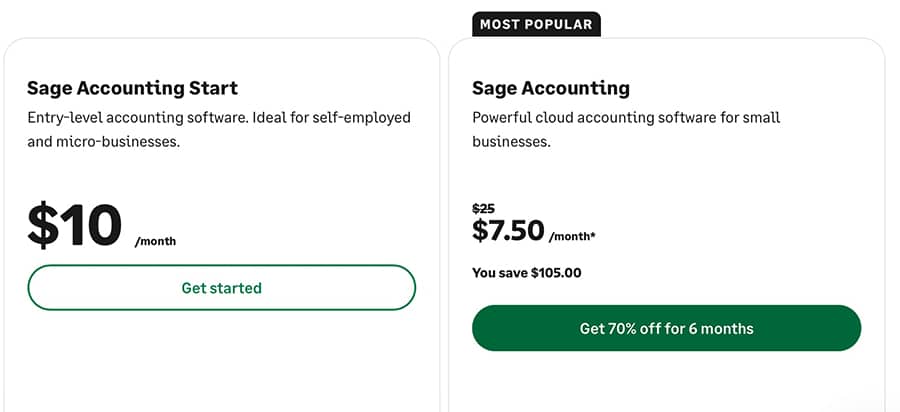

3. Sage — Excellent Tool for Providing Multiple Payment Options

Best For

Starting Price

Free Version

Payroll Included

Top 3 Features

Range of payment options

$10/month

30-day trial

Yes

– “Pay Now” button for invoices

– Several customizable templates

– Invoice automationPricing

Pros

Cons

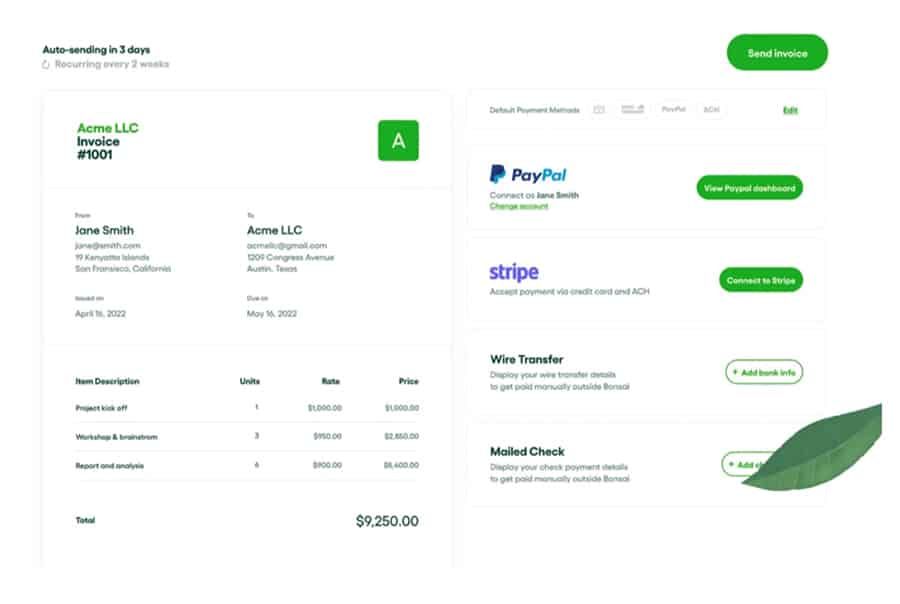

4. Bonsai — Top Choice If You Do Business with Clients Around the World

Best For

Starting Price

Free Version

Payroll Included

Top 3 Features

International invoicing

$25/month

14-day trial

No

– Invoice automation

– Range of free invoice templates

– Recurring and subscription billingPricing

Pros

Cons

5. QuickBooks — Best Invoice Software for Small Businesses Looking to Save Time with Automation

Best For

Starting Price

Free Version

Payroll Included

Top 3 Features

Small businesses

$15/month

30-day trial

Yes

– Automatically add billable hours to invoices

– Take payments on invoice

– Customizable invoicesPricing

Pros

Cons

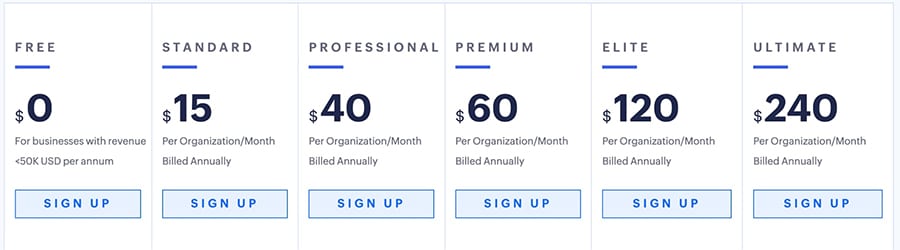

6. Zoho Accounting — Great Solution for Small Businesses Looking for Free Invoice Software

Best For

Starting Price

Free Version

Payroll Included

Top 3 Features

Free invoicing software

$15/month

Free for businesses under $50k annual revenue

No, but integrates with Zoho Payroll

– Multiple payment methods supported

– Automates payment records

– Validates and approves transactionsPricing

Pros

Cons

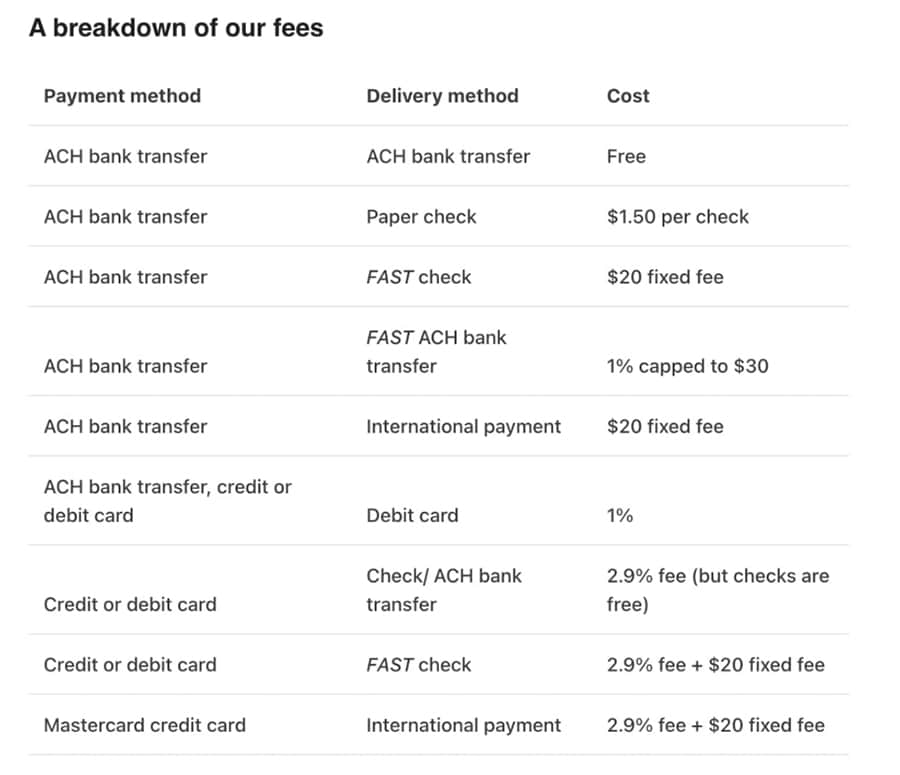

7. Melio — Robust Solution If You Work with a Complex Network of Vendors, Contractors, and Suppliers

Best For

Starting Price

Free Version

Payroll Included

Top 3 Features

Managing networks of clients, suppliers, and contractors

No subscription fees

Yes

Yes

– Share branded payment links

– Multiple payment methods

– Low credit card fees and free transfersPricing

Pros

Cons

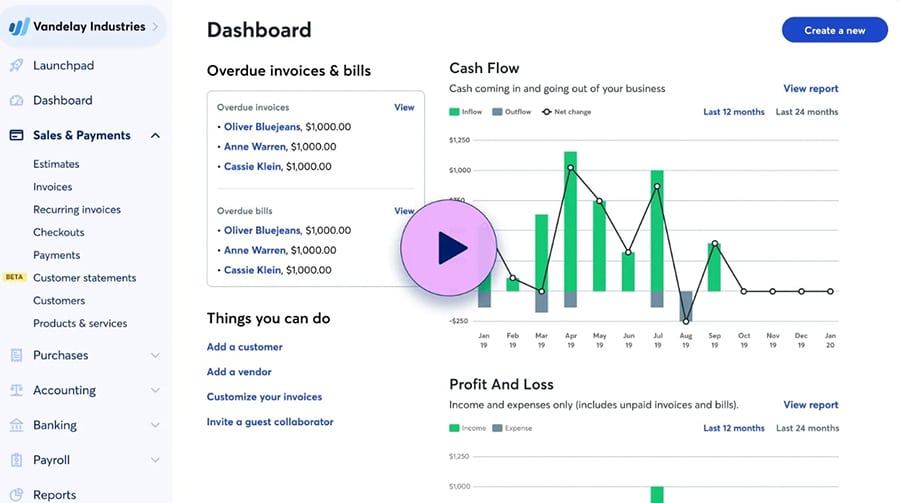

8. Wave — First-Rate Solution for Small Businesses Looking to Cut Costs

Best For

Starting Price

Free Version

Payroll Included

Top 3 Features

Businesses cutting costs

Invoicing and accounting are free

Yes

Yes

– Transparency into finances and invoices

– “Pay Now” invoice button

– Great mobile user experiencePricing

Pros

Cons

9. Xendoo Online — Smart Option If You’re Looking for Expert Accounting Support From Qualified Accountants

Best For

Starting Price

Free Version

Payroll Included

Top 3 Features

Comprehensive accounting support

$395/month

No

Yes

– Automated invoice reminders

– Support from qualified accountants

– Tax guidance and return-filing availablePricing

Pros

Cons

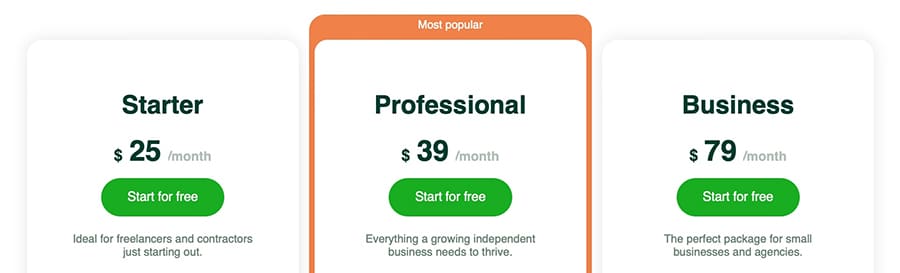

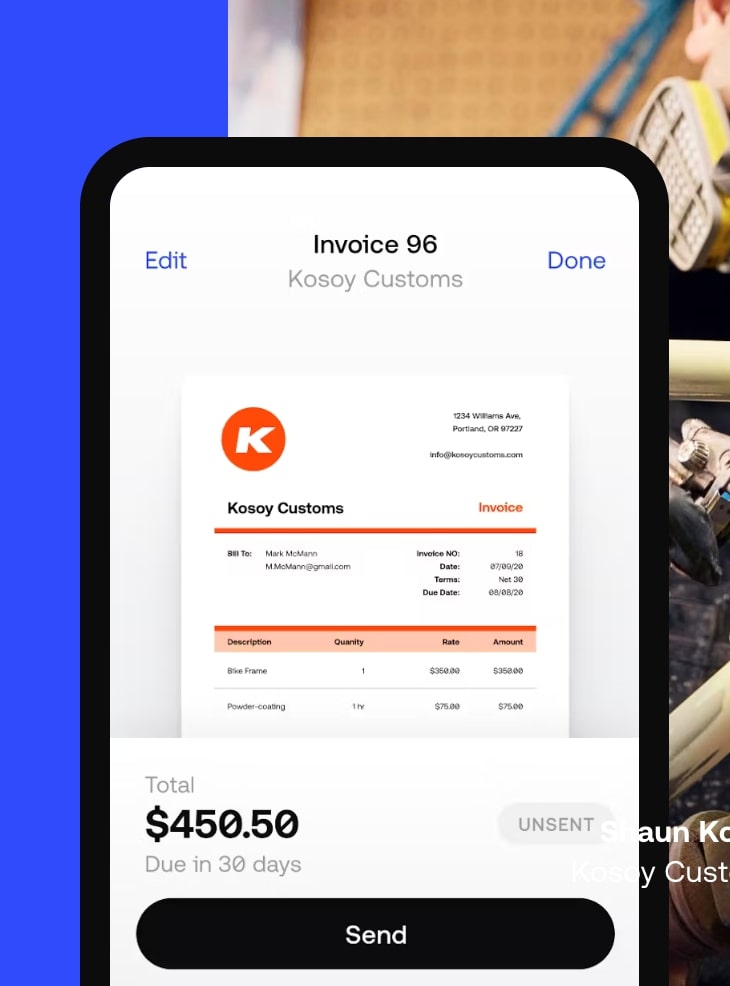

10. Invoice2go — Great Option for Contractors Going from Job to Job

Best For

Starting Price

Free Version

Payroll Included

Top 3 Features

Contractors on the move

$4.99/month (annual)

30-day free trial

Yes

– Share invoices via text, email, WhatsApp or Facebook

– Add billable hours to invoices

– Get notified about invoice paymentsPricing

Pros

Cons

Comparison of the Market’s Top Invoice Apps

Best Invoicing Software

Best For

Starting Price

Free Version

Top 3 Features

Payroll Included

FreshBooks

All-in-one invoicing solution

$8.50/month

30-day trial

– Great customization options

– Take deposits with a percent or flat fee

– Add-ons include Gusto PayrollYes

Oracle NetSuite

Larger businesses

$99/month

N/A

– Tailor invoices for subscription services

– Schedule and automate subscription changes

– Automate renewalsYes

Sage

Range of payment options

$10/month

30-day trial

– ‘Pay Now’ button for invoices

– Several customizable templates

– Invoice automationYes

Bonsai

International invoicing

$25/month

14-day trial

– Invoice automation

– Range of free invoice templates

– Recurring and subscription billingNo

QuickBooks

Small businesses

$15/month

30-day trial

– Automatically add billable hours to invoices

– Take payments on invoice

– Customizable invoicesYes

Zoho Accounting

Free invoicing software

$15/month

Free for businesses under $50k annual revenue

– Multiple payment methods supported

– Automates payment records

– Validates and approves transactionsNo, but integrates with Zoho Payroll

Melio

Managing networks of clients, suppliers, and contractors

No subscription fees

Yes

– Share branded payment links

– Multiple payment methods

– Low credit card fees and free transfersYes

Wave

Businesses cutting costs

Invoicing and accounting are free

Yes

– Transparency into finances and invoices

– “Pay Now” invoice button

– Great mobile user experienceYes

Xendoo Online

Comprehensive accounting support

$395/month

No

– Automated invoice reminders

– Support from qualified accountants

– Tax guidance and return-filing availableYes

Invoice2go

Contractors on the move

$4.99/month (annual)

30-day free trial

– Share invoices via text, email, WhatsApp or Facebook

– Add billable hours to invoices

– Get notified about invoice paymentsYes

Which Tool Offers the Best Free Invoice Software?

Key Factors to Consider When Choosing Invoicing Software

Automation Capabilities

Pricing

Customizability

User Experience

Consider Bonus Features and Support

Free Trials

How Do I Create An Invoice for My Small Business?

1. Select one of FreshBooks’ downloadable invoice templates

2. Fill out all the relevant details

3. Include payment information

Conclusion – What is the Best Invoicing Tool to Use in 2024?

Invoice Software FAQs

What is the best software to create invoices?

What is the best invoice system for small businesses?

Are Zoho invoices totally free?

Is Excel good for invoices?

How much is QuickBooks for invoicing?